The Rise of eCommerce

Most of us already knew we needed to embrace eCommerce, but the pandemic gave it a massive jumpstart. Companies that were lagging have had to get up to speed quickly or risk going under. That trend will only grow as the rise of eCommerce continues.

We’ve compiled insights from leading futurists and brand marketers about what changes are in store for retail for this three-part series of which you may have come here from Part 2. Through a survey and in-depth interviews, we’ve gained invaluable insights into how retailers should prepare to adapt. In part three of this series, we explore the changing retail landscape’s role and how it’s leading companies to restructure or adjust.

“With millions working from home, and digital connectivity taking even more of a hold on everyday habits, consumers will have greater motivations and fewer perceived barriers to more actively seeking technology-enabled solutions to assist in everyday tasks like shopping,” says Nielsen. “Companies that can leverage technologies—by meeting changing consumer demands online, enabling seamless interactions through direct-to-consumer offerings, and enhancing consumer experience with augmented and virtual realities—have the opportunity to earn consumer loyalty well after consumers’ concerns subside.”

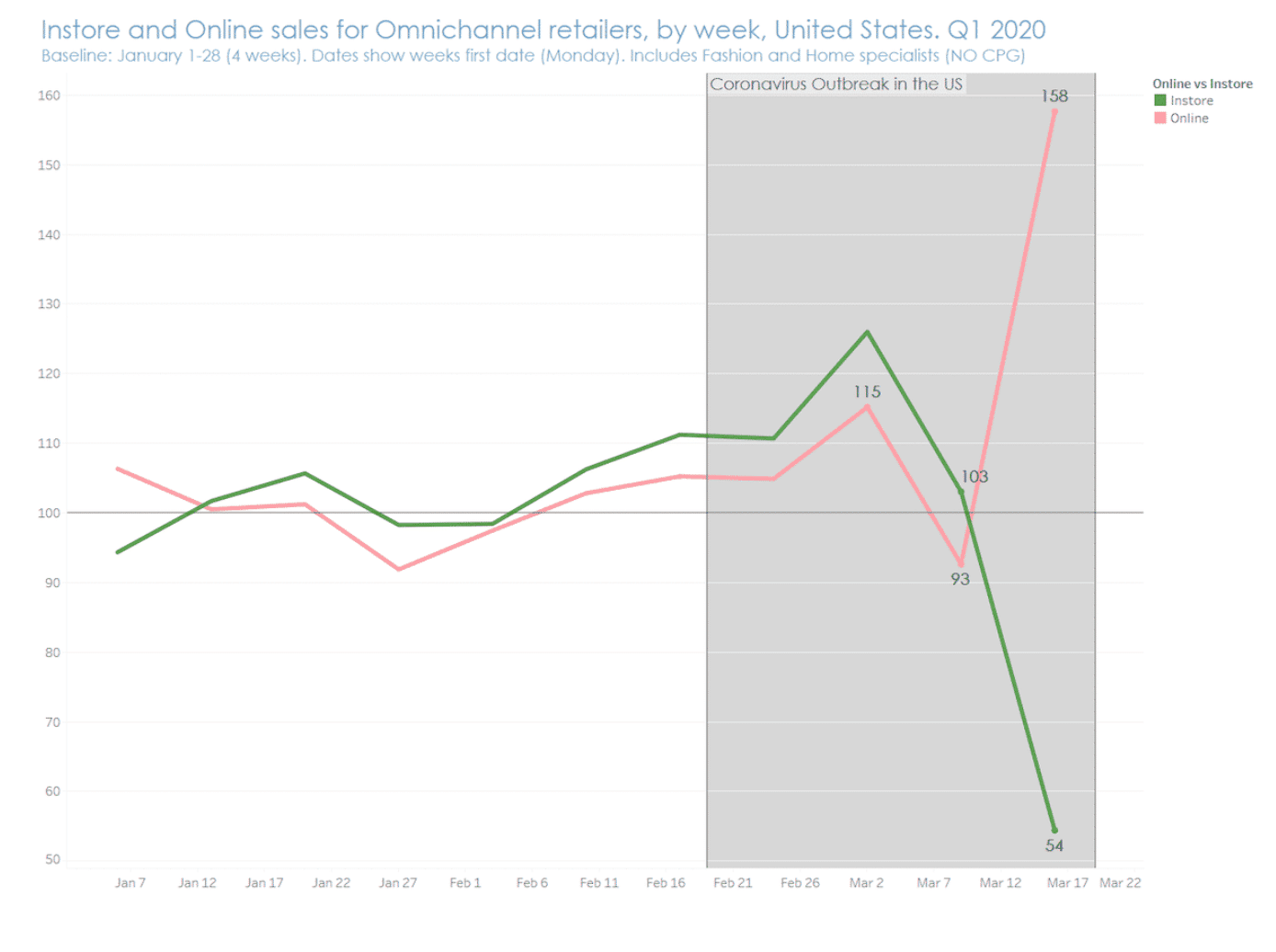

The foundation has been laid for significant changes in how retailers do business, as the American Marketing Association (AMA) points out. Ecommerce was expected to make up 30% of total retail sales by 2025—the pandemic just hastened its rise. According to Adobe Analytics, online sales rose by 49% in the U.S. compared to the previous year.

The coronavirus has propelled the growth of eCommerce, a study by Criteo found. Some retailers began making up for diminishing in-store sales in a week with an increase in online sales of up to 133%. Chameleon Collective Growth and Performance Marketing expert, Sean McBeth, is keeping a close watch on these trends.

Nielsen has reported a 91% growth in CPG eCommerce sales due to consumers shifting to online shopping. Ecommerce shopping surpassed 2019 Black Friday sales every day throughout April.

Increasingly, the online space will supplement the real-world space as a sphere of customer-brand interactions. Less browsing and impulse buying will occur in the future unless brands figure out a way to encourage these behaviors in the online space.

These innovations center on improving the customer experience—something the AMA stresses will be more important than ever in a post-pandemic world, particularly in saving time. Chameleon teammate Austin Malcomb, VP of Global ECommerce & Digital Marketing, understands this emphasis on experience will be felt worldwide.

Company Restructuring

We might see some critical trends within the company structure, processes, and marketing over the coming months and years.

Over 75% of survey respondents feel that retail will face enormous challenges in the six months after quarantine restrictions and social distancing guidelines are lifted. Over 55% expected their marketing spending to decline during that time frame, while close to 27% expected it to increase.

Small vs. Large Companies: Who Has the Advantage?

Many people wonder what the next iteration of companies like Amazon, Walmart, and Target will look like and how this will affect smaller companies.

Big retail will have an even more significant advantage in the post-pandemic world, says Forrester. Large companies have more resources with which to transition into new modes of operating. Many small businesses may be at a disadvantage because they have fewer resources with which to adapt. Still, those that have already begun transitioning to eCommerce will be better positioned for success.

However, department stores will find it increasingly difficult to compete with big-box stores that draw a broader customer base due to their more comprehensive selection, says CNN. For instance, JCPenney filed for bankruptcy in early May after struggling with long-term debt for a decade. The former retail giant has managed to reopen just 41 stores—5% of its former empire.

Simultaneously, small businesses are positioned to relate to and reach their customers better, understanding how to meet their needs and expectations. Those that can stick it out through the transition period could find themselves with a competitive advantage.

Streamlining Operations

With the focus on cost-saving and playing up the local angle, many companies are working to streamline their processes.

It may not be as necessary to rely on Amazon as companies thought. One sewing machine manufacturer learned that it could effectively handle most of its order fulfillment without Amazon, allowing it to cut out the middle man. It retained this out of necessity since Amazon prioritized other products for shipment that it considered essential during the pandemic height. “Amazon essentially cut us off and stopped ordering replenishment since our products aren’t considered essential. Now, people are buying from their brand.com site.”

By directly shipping to their customers, they can more effectively control their destiny, their eCommerce leader explained. On their biggest day in April, they made more than what they usually make in a typical month.

“This is forcing everyone, from consumers to businesses and corporate headquarters, to leapfrog into the acceptance of advancements they knew were coming; the propensity to resist has been removed in many cases,” says their eCommerce leader.

Smaller companies might handle their distribution in a more socially responsible way, which also resonates well with customers. Consumers’ desire to support their communities and country is expected to continue rising, and by moving production closer to the point of consumption, companies can emphasize local and responsible practices.

An Upsurge of “Brick and Clicks.”

Saving money on overhead by allowing people to work from home could free up more technological innovation funds. Marni Shapiro, the founding partner of The Retail Tracker, predicts a rise of “brick and clicks”—stores with a physical presence and a strong online element, allowing customers to check inventory before coming to the physical store (or merely ordering online).

These physical stores could essentially serve as a local or regional warehouse for goods. In many countries in Europe and Asia, people already shop online for groceries regularly. The U.S. is behind the curve in this respect, but we’ll see it catching up as people and businesses adapt to post-pandemic life.

“That kind of having to go to a place to get a thing . . . I think it’s just gonna feel very different,” says McGrath.

Similarly, we may see the end of “fast fashion,” says McGrath. “As environmental issues become higher on the agenda, our patterns may change,” she explains, saying that people will probably be less likely to wear a shirt twice and then get rid of it—partly due to necessity. Pricing will be built to account for environmental degradation and social costs stemming from the manufacturing of a product—i.e., the actual business cost.

“When everything is priced in, we have to pause to reconsider,” she states, asserting that companies will need to factor in how pollution from manufacturing affects the communities where they work and the planet as a whole. “We are going to see a lot of repricing of these very complex supply chains that companies like Amazon have created—so a four-dollar shirt becomes a forty-dollar shirt.”

The lead time for products may be longer, as companies won’t begin creating the product until they have purchased it, says McGrath. Customers may be willing to pay more and wait longer for products; earning their trust will be the key aim to strive for. “Brands need to start thinking through how they curate an experience and create a bond of trust—from big brands like Nike to small Etsy shop owners,” says McGrath. “Could Amazon’s brand be at risk because of this potential trend?”

What Stage of Adaptation are you in?

We have outlined five stages of adapting to today’s changing retail environment. In terms of the changes that could sustain your business and help it thrive in the new normal, what phase are you in?

- Crisis Management

- Settling the Ball

- Operational Efficiency

- Visioning for the Future

- Strategic Execution

Stage one involves a company’s initial responses to the crisis. In stage two, a company is reaching a more even keel in its crisis response, and a sense of normalcy begins to return. By stage three, the company has moved back into a highly productive mode. However, it needs to take further action to stay relevant, so it must move into stage four by visioning for both the immediate and long-term future. In stage five, the company enacts that vision through strategic plans, allowing it to maintain long-term loyalty from its customer base and continue to grow and flourish.

Ideally, you’ve reached the stage of visioning for the future—both immediate and long-term—so you can emerge ahead of the game from the crisis we’re all navigating. By working with the advice of the thought leaders that we’ve shared in this series, you can cultivate and leverage fresh ideas from the rise in eCommerce that keep you in tune with and responsive to your customer base by catering to their needs and expectations.

Sources

American Marketing Association, “The Big Shift: A Prediction of What’s to Come Post-Pandemic”

https://www.ama.org/marketing-news/the-big-shift-a-prediction-of-whats-to-come-post-pandemic/

Digital Commerce 360, “6 Ways the Coronavirus Pandemic Will Impact eCommerce”

https://www.digitalcommerce360.com/article/coronavirus-impact-online-retail/

Main Street, “New Report: The Impact of COVID-19 on Small Businesses”

https://www.mainstreet.org/blogs/national-main-street-center/2020/04/09/new-report-the-impact-of-covid-19-on-small-busines

Mashable, “People Shopped Online Every Day in April Like It Was Black Friday”

https://mashable.com/article/people-shopping-more-coronavirus/

Nielsen, “COVID-19: Tracking the Impact on FMCG, Retail and Media”

https://www.nielsen.com/us/en/insights/article/2020/covid-19-tracking-the-impact-on-fmcg-and-retail/

Nielsen, “Tracking the Unprecedented Impact of COVID-19 on U.S. CPG Shopping Behavior”